Acronyms

Definition | |

|---|---|

AGR | Advanced Gas-cooled Reactor |

AR4 | (CfD) Allocation Round 4 |

BEIS | Department for Business, Energy and Industrial Strategy |

BESS | British Energy Seurity Strategy |

CCA | Climate Change Act 2008 |

CCC | Committee on Climate Change |

CC(S)A | Climate Change (Scotland) Act 2009 |

CCS / CCUS | Carbon Capture (Use) and Storage |

CES | Crown Estate Scotland |

CfD | Contract for Difference |

COP | The UN's Conference of the Parties |

DSR | Demand Side Response, an ancillary service |

ESC | Energy Systems Catapult |

ETYS | NGESO's annual Electricity Ten Year Statement |

EV | Electric Vehicle |

FES | NGESO’s annual Future Energy Scenarios |

FID | Financial Investment Decision |

FR | Frequency Response, an ancillary service |

GB / UK | Northern Ireland operates under a different electricity market framework to the rest of Great Britain (GB). Great Britain (GB) is referenced in relation to electricity generation and transmission, and Scotland, or the UK, are referenced as the nation(s) which have legally committed to Net Zero carbon emissions. |

GDA | Generic Design Assessment (for nuclear reactors) |

GHG | Greenhouse Gas |

HND | Holistic Network Design, part of the Offshore Transmission Network Review |

HVDC | High Voltage Direct Current |

IPCC | Intergovernmental Panel on Climate Change |

LCOG | Levelised Cost of Generation |

LCTP | The UK’s Low Carbon Transition Plan |

NDC | Nationally Determined Contributions (to the Paris Agreement) |

NEPC | National Engineering Policy Centre |

NETS | National Electricity Transmission System |

NGESO | National Grid Electricity System Operator |

NIC | The UK’s National Infrastructure Commission |

NOA | NGESO’s annual Network Options Assessment |

NPS | National Policy Statements for Energy Infrastructure |

NTS | National Transmission System (for Gas) |

ONR | Office for Nuclear Regulation |

OWF | Offshore Wind Farm |

OREC | Offshore Renewable Energy Catapult |

PfG | Scottish 2021/22 Programme for Government |

RES | Renewable Energy Sources |

SMR | Small Modular Reactor |

SOF | NGESO’s System Operability Framework |

STW | Scottish Territorial Waters |

TCE | The Crown Estate |

TEC | Transmission Entry Capacity |

1. Executive Summary

1. Executive Summary

- This Statement of Need (the Statement) accompanies the application submitted to Marine Scotland Licencing Operations Team (MS-LOT) by Berwick Bank Windfarm Limited (the Applicant), to support the applications made under Section 36 of the Electricity Act 1989 for consent to install and operate Berwick Bank Wind Farm and associated infrastructure with a generation capacity exceeding 50 megawatts (MW) (the Project) and application for marine licences pursuant to the Marine (Scotland) Act 2010 and the Marine and Coastal Access Act 2009.

- The Project will include offshore and onshore infrastructure including an offshore generating station (array), offshore export cables to landfall and onshore transmission cables leading to an onshore substation with electrical balancing infrastructure, and connection to the electricity transmission network. The offshore components of the Project seaward of MHWS are referred to as the Proposed Development.

- The array comprises 307 wind turbines, with an estimated capacity of 4.1 gigawatt (GW). The array will be approximately 47.6 km offshore of the East Lothian coastline and 37.8 km from the Scottish Borders coastline at St, Abbs. It lies to the south of the offshore wind farms known as Seagreen and Seagreen 1A, south-east of Inch Cape and east of Neart Na Goaithe.

- As the majority of the Project is located in Scottish Waters, the Scottish Ministers are the primary Regulatory Authority in respect of the necessary consents and licences required for the construction and operation of an offshore wind farm project. To allow the Scottish Ministers to properly consider the development proposals, developers are required to provide information which demonstrates compliance with the relevant legislation and allows adequate understanding of the material considerations.

- Consent is required under Section 36 of the Electricity Act 1989, as well as a Marine Licence obtained under the Marine (Scotland) Act 2010 and the Marine and Coastal Access Act 2009. Habitats Regulations Appraisal consent is also required under The Conservation (Natural Habitats, & c.) Regulations 1994 as amended, The Conservation of Habitats and Species Regulations 2017 (both referred to as the “Habitats Regulations”) and the Offshore Marine Conservation (Natural Habitats &c) Regulations 2007 / The Conservation of Offshore Marine Habitats and Species Regulations 2017, as amended (referred to as the “Offshore Habitats Regulations”). Where an offshore energy project, such as an offshore wind farm, requires Section 36 Consent and a Marine Licence, MS-LOT, on behalf of the Scottish Ministers, can process both consent applications jointly

- The Project has secured Grid Connection Offers from National Grid Electricity System Operator (NGESO) for 4.1GW of Transmission Entry Capacity.

- This Statement for offshore wind describes how and why the Proposed Development addresses all relevant aspects of established and emerging Scottish government and UK government Policy.

- The case for need is built upon the contribution of the Project to the three important policy aims of decarbonisation:

- Net Zero and the importance of deploying zero-carbon generation assets at scale;

- Security of supply (geographically and technologically diverse supplies); and

- Affordability.

- Section 2 provides an overview of legislation relevant to Scotland, principally the commitment made through the Climate Change (Emissions Reduction Targets) (Scotland) Act 2019, to reduce emissions of all major greenhouse gases by at least 100% by 2045 from 1990 levels. UK legislation is also discussed, to the extent it relates to the legal commitment made by the UK government, covering England, Scotland, Wales and Northern Ireland, to achieve Net Zero by 2050, thereby ending the UK’s contribution to global warming within 30 years.

- Section 3 describes how decarbonisation in Scotland and the wider UK has been achieved to date, and sets out why further decarbonisation is needed urgently to meet national climate commitments. The section also includes descriptions of the key policies in place for both Scotland and the UK to drive to their respective Net Zero targets. The section concludes that all new low carbon power generation projects which will make valuable contributions to achieving Net Zero, should be delivered as soon as possible. Many more projects than those currently in development pipelines will be required under all potential future scenarios of how to meet Net Zero.

- Section 4 analyses future Scottish and UK electricity demand and concludes that it will grow significantly through strategic actions to achieve decarbonisation-through- electrification of other industry sectors, and this underpins the urgent need for significant new low carbon electricity generation developments in Scotland and the UK.

- Section 5 provides an up-to-date view of the past and potential future contributions of key technologies to decarbonisation in the UK, and describes expert future views of what constitutes a Net Zero consistent energy system, and the considerations needed now to balance decarbonisation with security of supply and affordability.

- Section 6 describes in detail how the Project supports decarbonisation through an assessment of its contribution to the various quantifiable 2030 targets set by the Scottish and UK governments as a pathway to meeting their climate change commitments.

- Section 7 analyses the contribution of offshore wind generation to security of supply, from the perspectives of sufficient electricity supply, and of system operation. The section concludes that the Project, if consented, would make a significant contribution to an adequate and dependable GB generation mix.

- Section 8 provides an analysis of commercial aspects of large-scale offshore wind, as a future contributor to a low carbon GB electricity supply system, in comparison to alternate technologies.

- Section 9 lists the conclusions of this Statement of Need. Namely, that significant capacities of low carbon offshore wind generation are needed in Scotland and in the UK. Therefore, the Project, if consented, will help meet Scottish government and UK government objectives of delivering sustainable development to enable decarbonisation, ensuring our energy supply is secure, low carbon and provides benefits to GB consumers.

- It is the view of the author of this report that the Project presents a significant low regrets opportunity for Scotland to make progress against its 2045 legal commitments, by bringing to operation a large capacity of low carbon power generation from the mid 2020s. The Project will enable Scotland to reduce further the carbon content of the power it consumes, as well as to enable the decarbonisation of Scottish heat and transport energy consumption either directly or through growth in Scottish hydrogen electrolysis facilities. Without the Project, Scotland will require more imports of electricity from the wider UK for longer to meet its growing electricity demand. Because Scotland is already further ahead than the wider UK in decarbonising its electricity supply, imported electricity is likely to have been generated with a higher carbon content, therefore potentially jeopardising Scotland's progress to Net Zero by 2045.

- Scotland is also a key contributor to efforts to decarbonise the wider UK, and if a significant capacity of offshore wind generation is not built out to a scale comparable with that in the projections provided by NGESO and others, then the UK will be highly unlikely to continue to reduce its carbon emissions over the coming decade, and ultimately may fail to meet its legally binding decarbonisation targets.

- The Project will provide a significant and vital contribution towards meeting Scottish policy objectives for the energy sector, the Scottish need and the UK need for renewable energy, and the ambitions of the Offshore Wind Sector Deal for sustainable growth and economic benefit.

- The Project is a low-risk, low regrets opportunity because of its proposed location and selected technology. If delivered, it will make a significant and important contribution to decarbonisation, security of supply and affordability in the appropriate timeframes, especially if positioned against other technologies and/or development which currently carry more development or economic risk, and/or deliver over longer timescales. The Project is wholly consistent with Scottish Energy Strategy and UK energy policy, and its development will be critical if Scottish policy aims, and UK-wide policy aims, are to be achieved.

- This Statement has been prepared by Si Gillett, M.A.(Oxon), M.Sc.(Dist) and sets out the case for why offshore wind is a critically important generation technology to include within the future generation mix of both Scotland and the UK. This Statement predominantly calls on established and emerging primary analysis and opinion by respected experts, to support the case that the Project will help Scotland and the UK meet their legally binding carbon emissions targets, while enhancing national security of supply, and at a cost which, in relation to other electricity generation infrastructure developments, provides value for money for end-use consumers.

2. Legislation landscape

2. Legislation landscape

2.1. Overview

2.1. Overview

- This section describes the legislative landscape relevant for low carbon electricity generation asset development and describes the legal commitments made by both the UK and Scotland to deliver against climate change targets.

- Legal decarbonisation commitments have been made by Scotland and also by the United Kingdom of Great Britain and Northern Ireland (UK). The UK commitment covers Scotland, Wales, England and Northern Ireland.

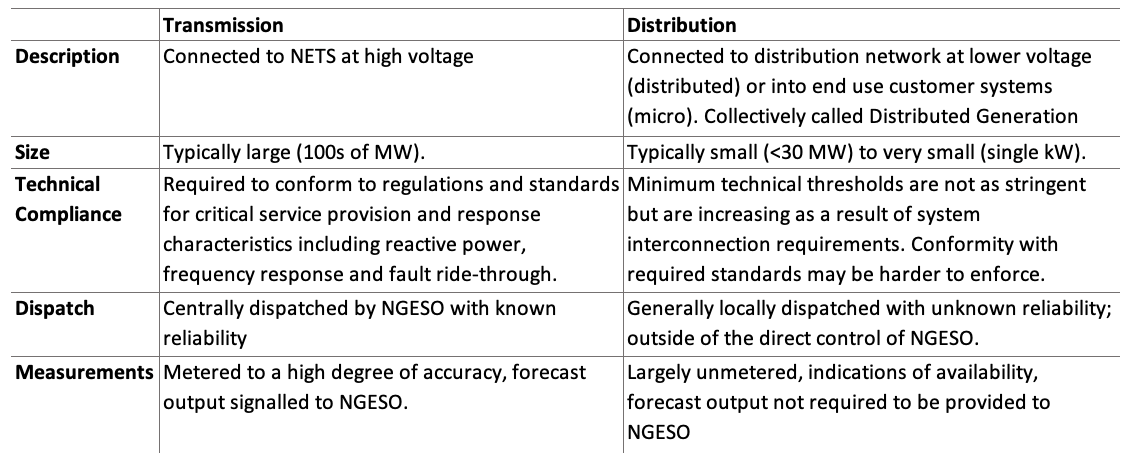

- Electricity generation is an important sector for climate change, because although historically it has been a significant carbon emitter, it is now the critical enabler of deep decarbonisation across society. Electricity generation and supply in Scotland, Wales and England are connected by the National Electricity Transmission System (NETS), and the same set of operating and commercial rules applies across the NETS (although there are some geographical differences).

- While Northern Ireland is attached to the mainland NETS through two interconnectors, it operates under a different electricity market framework. This Statement of Need therefore refers to Great Britain (GB) in relation to electricity generation and transmission, and we refer to Scotland, or the UK, as the nation which has legally committed itself to Net Zero carbon emissions.

2.2. Climate Change (Scotland) Act 2009

2.2. Climate Change (Scotland) Act 2009

- The Climate Change (Scotland) Act 2009 (CC(S)A) creates the statutory framework for greenhouse gas emissions reductions in Scotland by setting interim and ultimate targets for emission reductions. CC(S)A also provides the power for interim targets to be varied based on expert advice, and requires the Scottish Ministers to set annual targets, in secondary legislation, for Scottish emissions from 2010 to 2050. Scottish Ministers take advice from the Committee on Climate Change (CCC, see Section 2.3) on the targets they set, although a Scottish Committee on Climate change may be established to provide such advice.

- Secondary legislation has been made under CC(S)A to set annual targets, establish a framework for carbon accounting and introduce legislation requiring regular reporting on compliance with climate change duties among other requirements. Scotland's initial targets were to reduce emissions by 42% for 2020, and 80% by 2050, from 1990 levels.

2.3. Climate Change Act 2008

2.3. Climate Change Act 2008

- The UK government, through Climate Change Act 2008 (CCA), made the UK the first country in the world to set legally binding carbon budgets, aiming to cut emissions (versus 1990 baselines) by 34% by 2020 and at least 80% by 2050, “through investment in energy efficiency and clean energy technologies such as renewables, nuclear and carbon capture and storage.” [1].

- CCA committed the UK to sourcing 15% of its total energy (across the sectors of transport, electricity and heat) from renewable sources by 2020 and new projects were expected to need to continue to come forward urgently to ensure that this target was met. Government projections made in 2011 suggested that by 2020 about 30% or more of GB electricity generation – both centralised and small-scale – could come from renewable sources.

- CCA is underpinned by further legislation and policy measures. Many of these have been consolidated in the UK Low Carbon Transition Plan [1], and UK Clean Growth Strategy (2017) [2]. A statutory body, the CCC, was also created by CCA, to advise the United Kingdom and devolved governments and Parliaments on tackling and preparing for climate change, and to advise on setting carbon budgets.

- The UK government has set five-yearly carbon budgets which currently run until 2037, the process for setting the sixth carbon budget having concluded in April 2021. The UK met its first and second carbon budgets and is on track to outperform the third (2018 to 2022) – partly attributable to effective policy, but also attributed to changes in the applicable Emissions Trading Scheme(s) and the impact of COVID-19 on emissions [3].

- The CCC also report regularly to the Parliaments and Assemblies on the progress made in reducing greenhouse gas emissions.

2.4. COP21 / UNFCC Paris Convention and subsequent actions

2.4. COP21 / UNFCC Paris Convention and subsequent actions

- The global context for the need for greater capacities of low carbon generation in Scotland, the wider UK and elsewhere to come forward with pace, has developed significantly over the last seven years. In 2015, at the 21st Conference of the Parties (COP21), for the first time ever, every country agreed to work together to limit global warming to well below 2ºC and to aim for 1.5ºC; to adapt to the impacts of a changing climate; and to make money available to deliver on these aims. The commitment to aim for 1.5ºC is important because every fraction of a degree of warming will result in many more lives lost and livelihoods damaged. Importantly therefore, every delay to decarbonisation action, because it allows for carbon emissions and therefore global warming to continue, also results in lives lost and livelihoods damaged. The Paris Agreement sets out that every 5 years countries must set out increasingly ambitious climate action, hence the need for internationally available plans for reducing emissions, known as Nationally Determined Contributions (NDCs) [4].

- In October 2018, following the adoption by the UN Framework Convention on Climate Change of the Paris Agreement, the Intergovernmental Panel on Climate Change (IPCC) published a “Special Report on the impacts of global warming of 1.5°C above pre-industrial levels”. The report concluded that human-induced warming had already reached approximately 1ºC above pre-industrial levels, and that without a significant and rapid decline in emissions across all sectors, global warming would not be likely to be contained, and therefore more urgent international action is required. The ambition against which CC(S)A and CCA were established had been extended, and carbon emissions reduction targets in Scotland and the UK have subsequently been tightened.

- In response to the IPCC report, in May 2019, the CCC published "Net Zero: The UK’s contribution to stopping global warming.” [5]. The report recommended extensions to the ambition established in existing legislation.

- In recognising that Scotland has a “greater relative capacity to remove emissions than the UK as a whole” CCC recommended a Net Zero date of 2045 for Scotland [6]. As a result, CC(S)A was amended by Climate Change (Emissions Reduction Targets) (Scotland) Act 2019 to reduce emissions of all major greenhouse gases by at least 100% by 2045 from 1990 levels, with interim targets of at least:

- 56% by 2020;

- 75% by 2030; and

- 90% by 2040.

- Scottish Government has also published an indicative Nationally Determined Contribution: “A 2030 target to reduce emissions of all major greenhouse gases by at least 75%, compared to a 1990/1995 baseline. This target is legally binding in Scotland’s domestic law and was set in direct response to the aims of the Paris Agreement.” [7]. Scotland’s targets and delivery plans are reflected in the UK’s Nationally Determined Contribution. On the “GHG Account” basis, against which performance against the legislated targets is assessed, the CCC assessed Scotland's 2019 emissions at 51.5% below 1990 levels, meaning that Scotland missed its 2019 annual target for a 55% reduction.

- The CCC also recommended that “The UK should set and vigorously pursue an ambitious target to reduce greenhouse gas emissions (GHGs) to Net Zero by 2050, ending the UK’s contribution to global warming within 30 years.” The CCC believed that this recommendation was "necessary [against the context of international scientific studies], feasible [in that the technology to deliver the recommendation already exists] and cost-effective”, reporting that "falling costs for key technologies mean that … renewable power (e.g. solar, wind) is now as cheap as or cheaper than fossil fuels”. Importantly, the CCC recommendation identifies a need for low carbon infrastructure development and points to an increased urgency for action.

- The UK implemented the CCC’s recommendation into law by the laying of a statutory instrument in UK Parliament in June 2019, which amended CCA. The UK thus became the first major economy to pass laws to end its contribution to global warming by 2050.

- Also in May 2019, the CCC reported to Parliament that “UK action to curb greenhouse gas emissions is lagging behind what is needed to meet legally-binding emissions targets” [8]. The UK is on track to outperform its third Carbon Budget (2018 to 2022), but is not currently on track to meet the fourth (2023-2027) or fifth (2028-2032). Recognising the need for progress in decarbonisation to continue, the CCCs recommendations for a sixth carbon budget, running from 2033 – 2037, included measures which, when delivered, will result in a 78% reduction in UK territorial emissions between 1990 and 2035, in effect, bringing forwards the UK’s previous 80% target by nearly 15 years [3].

- In December 2020, the UK formally submitted its NDC to the UNFCCC under the Paris Agreement. The UK commitment covers England, Scotland, Wales and Northern Ireland and the commitment is an at least 68% economy-wide net reduction in GHG emissions by 2030 compared to reference year levels [9], and CCC's recommendations for the Sixth Carbon Budget were legally adopted in April 2021. Figure 2‑1 shows the CCC's advice on the level of the Sixth Carbon Budget. The Sixth Carbon Budget will require emissions to reduce by 2035 to 78% below 1990 levels, including the UK’s share of international aviation and international shipping emissions. The budget equates to a 63% reduction on 2019 emissions, by when emissions had already fallen around 40% since 1990.

2.5. COP26: Uniting the world to tackle climate change

2.5. COP26: Uniting the world to tackle climate change

- The 26th UN Climate Change Conference of the Parties (COP26) was held in Glasgow on 31 October – 13 November 2021. COP26 brought parties together to accelerate action towards the goals of the Paris Agreement and the UN Framework Convention on Climate Change. As the first COP since the first NDCs had been published since Paris, the run up to COP26 in Glasgow was a critical moment in the world’s mission to keep the hope of limiting global temperature rises to 1.5°C alive [4]. International pledges could be reviewed and amalgamated, and a view of global commitments made towards limiting carbon

emissions and adapting to climate change could be created for the first time.

Figure 2‑1: The UK's six Carbon Budgets and trajectory to Net Zero 2050

[3]

- Agreements were reached on many themes at COP26, including: science and urgency; adaption; adaption finance; mitigation; finance, technology transfer and capacity-building for mitigation and adaptation; loss and damage; implementation; collaboration; and confirmation and developments of elements of the Paris rulebook.

- Of greatest relevance to this Statement of Need, specifically because collective progress to date to reduce emissions has not been sufficient, are the outcomes agreed at COP26 relating to mitigation: setting out the steps and commitments that Parties will take to accelerate efforts to reduce emissions “to keep 1.5°C in reach”. Key achievements at COP26 under the theme of mitigation include [10]:

- Over 90% of world Gross Domestic Product and around 90% of global emissions are now covered by net zero commitments and 153 countries have put forward new or updated emissions NDCs, which collectively cover around 80% of the world’s greenhouse gas emissions. Net Zero is a global endeavour and the world is getting on board;

- The importance of action now to address the urgency of climate change and drive emissions down before 2030 was cemented in an agreement from all parties to revisit and strengthen their current emissions targets to 2030, in 2022;

- The role of clean electricity in delivering climate action, and the importance of driving down emissions from fossil fuel generators as well as increase capacity of renewable generators, was acknowledged in the negotiated agreement by 190 countries at COP26 to “phase down coal power”. Further commitments to cease international coal finance and direct public support of unabated fossil fuel energy, by the end of 2021 and 2022 respectively, will free funds to be redirected for deployment in renewable energy;

- Accounting for over 10% of global greenhouse gas emissions, and around half the world’s consumption of oil, road transport is a critical sector to decarbonise with pace. Agreement was reached by countries, cities, companies, investors and vehicle manufacturers to target all new car and van sales to be zero emission by 2040 globally and 2035 in leading market, and ultimately to phase our fossil fuelled vehicles. Electrification of transport is inevitable, underway and accelerating. Low carbon electricity supply must keep growing to provide the energy to enable the rapid displacement of oil.

- It is appropriate that COP26 was held in Scotland, because of the significant leadership and progress shown by Scotland through its climate actions and ambitious climate change targets. And as the COP26 Outcomes report reminds its readers: “we must continue the work of COP26 with concerted and immediate global effort to deliver on all pledges” in order to keep alive the hope of limiting the rise in global temperature to 1.5°C.

- The Project presents an opportunity for Scotland to underpin its delivery on the COP26 mitigation pledges:

- Scotland has its own indicative NDCs, and the Project is a critical measure in support of achieving those commitments, by providing new low carbon electricity generation facilities in Scotland to power heat transport and industrial demand and save emissions;

- The Project will generate low carbon power in the critical 2020s and therefore before the current emissions targets date of 2030. Early action to decarbonise is important in the climate fight;

- The Project will generate power in Scotland, meaning that less power generated in the UK needs to flow north at times of higher demand and lower supply, bringing with it the carbon emissions associated with an electricity mix which currently still includes fossil fuel fired power stations;

- Scotland is leading the way globally in electrifying vehicles and the Project will be an essential source of low carbon power to keep Scottish people and businesses moving in new electric vehicles while at the same time, saving carbon emissions.

- A comparable analysis illustrates that the Project brings comparable support to the UK's decarbonisation plans.

3. Historical decarbonisation and policies for the future

3. Historical decarbonisation and policies for the future

3.1. Nationally Determined Contributions

3.1. Nationally Determined Contributions

- NDCs are stepping stones to achieving Net Zero commitments and policies are therefore in place to support Scotland (and the UK) to the progressive achievement of Net Zero. This section describes how Scotland and the UK have performed against their legislative targets to date; and sets out the current plans and policies in place to deliver further decarbonisation. It lists those Scottish (and UK) policy positions which are driving emissions to Net Zero and which are relevant to the Project.

- The Scottish government has its own statutory emissions reduction targets. The Scottish NDC publication quoted above also refers to the Scottish NDC (which align with the commitments made in the Climate Change (Scotland) Act 2009 as amended) and were informed by the Paris Agreement. Progress towards these targets also contributes to achievement of UK-wide targets. The decision on the UK’s NDC headline target was led by BEIS and agreed through UK Government governance structures at official and ministerial levels. The target level in the UK's NDC was informed by the UK’s commitments under the Paris Agreement, the legally-binding net zero commitment, and guidance from the CCC.

3.2. How decarbonisation has been achieved to date

3.2. How decarbonisation has been achieved to date

- UK territorial greenhouse gas emissions, including those from power generation, have reduced since 1990, as shown in Figure 3‑1. Over the period 1990 to 2021, power station emissions reduced to just 26% of their 1990 value while emissions from other sectors reduced to 61% of their 1990 value [11]. This was despite Total Final User Electricity Consumption (a BEIS definition) in the UK increasing from 274.4TWh to 286.1TWh over the same period [12]. Reductions in the UK power sector have been achieved through many initiatives and circumstances.

- Electricity volumes generated from coal and gas fired power plants has reduced. The Large Combustible Plant Directive (aiming to improve air quality but also having significant carbon reduction benefits) required the clean up or time-limited operation of coal-fired power generation prior to 2016. Between 2012 and 2015, at least 11.5GW of coal plant decommissioned as a result of the Directive and Scotland's last coal fired power plant closed in 2016.

- GB’s second-generation nuclear fleet (9GW) has operated significantly past its original decommissioning dates. Nuclear provided 16% of electricity demand in 2020 from two stations in Scotland (2.3GW) and six stations in England (6.8GW), all with low carbon emissions [13], however the decommissioning of existing plants commenced in 2021 including 1.0GW in Scotland and 2.1GW in England. Advances in new nuclear plants to replace the existing fleet have been slower than was originally foreseen (see Section 5.3.2).

Figure 3‑1: UK territorial greenhouse gas emissions 1990 to 2021

[11]

- The transformation of Scottish electricity generation capacity over the last six years has been charted in Figure 3‑2. Scotland's last coal fired power plant closed in 2016. Hunterston and Torness nuclear power stations have run on past their original end of life estimates. Hunterston has just recently closed after more than 45 years of low carbon electricity generation, and Torness is currently capable of operating at full power 1.3GW). As of March 2022, Scotland had 13.3GW of renewable electricity generation capacity, of which 8.7GW was onshore wind and 1.9GW was offshore wind [14]. The CCC recognise that there are now only limited further reductions possible from electricity generation, so meeting Scotland's climate change targets now requires significant progress on decarbonisation across a range of other sectors including the electrification of transport, heat and industrial demand, which in turn requires an increase in low carbon electricity generation capacity [15].

- Decarbonisation of electricity generation in the UK has been achieved in very similar ways, see Figure 3‑3. In late 2017, UK government announced a commitment to a programme that will phase coal out of all electricity generation by 2025, a date which during 2020 was brought forwards to 2024. National carbon pricing aims to attribute additional marginal costs (see Section 8.2) to coal plant, therefore signalling their dispatch only when other less carbon intensive assets have been exhausted. In June 2020, Britain ended a record run of not generating any electricity from coal for 1,630 consecutive hours – the longest period since the 1880s. In 2019, many asset operators announced the closure of their coal generation assets. Just one coal station (Ratcliffe, 2.0GW) remained commercially operational beyond September 2021 with four other units (two at West Burton A and two at Drax, with a combined generation capacity of 2.2GW) responding to system stress events only since 1st October 2021 until their closure (currently scheduled for March 2023). Ratcliffe is currently signalling that it will close by [Author Analysis].

Figure 3‑2: Estimated Scottish commercially operational capacity, Q115 - Q422

[Author Analysis]

- Low carbon variable generation, predominantly wind and solar, has been deployed to the GB grid more quickly and more widely than originally projected. At the time of writing this report, 13GW of offshore wind and 13.6GW of onshore wind has already been “built” and connected to the NETS as at July 2022 (i.e. is in an operational status), with a further (estimated) 13.8GW of solar PV connected to distribution networks [107].

- Investors have increasingly been attracted to technologies (such as renewables) which are eligible for government-backed support programs (such as the Contract for Difference), which address the market risk and long-term price uncertainty associated with the GB electricity market. Interest from investors and developers in these technologies has driven technical development and competition on cost. Consequently, UK government has repeatedly confirmed the important role the CfD mechanism plays in bringing forwards new large-scale low carbon generation, and Allocation Round 4 (AR4) contracts were awarded in the summer of 2022. As an indicator of the importance of wind as a technology class within the evolving GB electricity system, and an indicator of the competitive cost of the technology, over 8.5GW of wind capacity across 22 projects secured Contracts for Difference (CfD) in AR4, at an initial strike price ranging from £37.35/MWh (Offshore Wind) to £87.30/MWh (Floating Offshore Wind). All CfDs commence in either 2024/25 (Onshore Wind) or 2026/27 (all Offshore Wind technologies).

Figure 3‑3: Estimated UK commercially operational capacity, Q115 - Q422

[Author Analysis]

3.3. The urgent need to decarbonise

3.3. The urgent need to decarbonise

- The timescales for building out new, large-scale generation projects are generally long. Those in planning today may not generate their first MWh of carbon-free electricity for a further 5 or more years. However the need for decarbonisation grows stronger each year, because every year during which no action is taken, more carbon is released into the atmosphere, global temperatures rise and the global warming effect accelerates. Therefore early action will have a correspondingly more beneficial impact on our ability to meet Net Zero targets than will later action. The Project is already well progressed in development, so can deliver much needed large scale capacity much sooner than other projects moving into development. In June the International Energy Agency (IEA) issued a call to arms on energy innovation, stating that the world “won’t hit climate goals unless energy innovation is rapidly accelerated ... About three-quarters of the cumulative reductions in carbon emissions to get on [a path which will meet climate goals] will need to come from technologies that have ‘not yet reached full maturity” [17]. DNV GL expressed this observation in a different way: "Measures today will have a disproportionately higher impact than those in five to ten years’ time” [18].

Figure 3‑4: Power generation emissions must reduce to negative in the early 2030s in order to meet 2050 Net Zero targets

[107]

- Section 4.3 will explain that the pathway for both Scotland and the UK to achieve Net Zero must involve wider transitions outside of the power generation sector. Therefore, the power generation sector must first decarbonise in order to enable the successive decarbonisation of transport, industry, agriculture and the home. While the CCC have suggested that this is already the case in Scotland [15] they have also noted the significant progress required in decarbonising other Scottish sectors, and therefore new low carbon generation capacity is required in Scotland in order to meet additional demand for electricity. Not only will new low carbon generation in Scotland reduce electricity imports to Scotland from the rest of the UK (which has higher average carbon emissions than indigenously generated Scottish low carbon generation) but also will act to reduce the UK's average power sector carbon emissions further. NGESO analysis points to the requirement to reduce emissions from the UK power generation sector to below zero in the early 2030s, as shown in Figure 3‑4. The scale and pace of change required within this sector, in order to meet a negative emissions target, is immense.

- Put simply, the urgency with which the power sector is required to be decarbonised is immense and actions must proceed with unrelenting pace. Any delay in reducing carbon emissions today results in more carbon to be emitted to the atmosphere, and global temperatures will rise. The speed with which subsequent carbon emissions must be halted therefore increases, or else the Paris Agreement aim of 1.5°C temperature rise versus pre-industrial levels comes under threat. A rise in global temperatures above 1.5°C comes with the potential for irreversible climate change, the potential for widespread loss of life and severe damage to livelihoods, and an urgent increase in the deployment of adaptive technologies to protect human existence from climate change. Any delays incurred now, make the challenge increasingly more difficult for the years ahead.

- The UK Industrial Decarbonisation Strategy [19] clearly states the objective for the 2020s, which “will be crucial ... to lay the bedrock for industrial decarbonisation. Over the next decade ... the journey of switching away from fossil fuel combustion to low carbon alternatives such as hydrogen and electrification [will begin, alongside] deploying key technologies such as carbon capture, usage and storage”. In conclusion, to address the ongoing climate emergency, it is critical that the UK develops a large capacity of low carbon generation, and it is critical that this development occurs urgently – in the near-term and not just later – to facilitate wider decarbonisation actions. It is also important for schemes with long development timescales to continue progressing their plans to achieve carbon reduction in decades to come.

- Developments with the proven ability to achieve savings in this decade, and even more importantly in the early part of this decade, must be consented. It is these developments which are most critical to keeping the world to its required carbon reduction path. An actual, potential or aspirational pipeline for longer term low carbon generation schemes presents additional opportunity for future decarbonisation, but does not present a valid argument against consenting and developing projects with proven near-term deliverability, and dependable decarbonisation benefits.

- The Project is a viable proposal, with a strong likelihood of near-term deliverability, which will achieve significant carbon reduction benefits through the deployment of a proven, low-cost technology in a very suitable location. As such, the Project possesses exactly those attributes identified as being required both in the near-term and in the future in order to continue to make material gains in carbon reduction.

3.4. Current Scottish policies to meet net zero

3.4. Current Scottish policies to meet net zero

- Scotland has declared a climate emergency. As host of the Conference of the Parties 26 (COP26), held in Glasgow in November 2021, Scotland demonstrated its position of international leadership on climate change. In August 2021, the Scottish First Minister sent a letter to the Prime Minister [20]. The letter confirmed Scotland’s position at the “forefront of global efforts to achieve the aims of the UN Paris Agreement”; recognised that climate change, as an inherently global issue, “can only be addressed through co-ordinated international effort and working with others” and urged “all of us who hold positions of leadership to consider what more we can, and must, do to meet [the challenge to limit global temperature rise to 1.5°C in the longer term]”. Scotland has established legally binding targets to meet Net Zero by 2045 at the latest with a world-leading interim 2030 target (which is also Scotland's legally binding indicative Nationally Determined Contribution) of a 75% reduction in emissions against a 1990/95 baseline [7]. Scotland's updated Climate Change Plan [21] sets out how Scotland will deliver that ambition. Scotland's targets and delivery plans are reflected in the UK's NDC commitments and as such Scotland is a critical contributor to the achievement of the wider UK’s NDC commitments.

- Scotland has progressively established policy positions related to climate change and the delivery of a just transition to incorporate and embed low carbon living into its social and environmental fabric. The Scottish government also recognises the benefits associated with capturing opportunities for growth in offshore wind and related services, including for domestic and international deployment. Since launching the Offshore Wind Sector Deal in March 2019, the Scottish and UK governments have worked together with the offshore wind sector to make progress on delivering the commitments that it contains. The Scottish government is represented across all main Sector Deal work streams, and is working closely with the UK government to deliver a number of key outputs from the Sector Deal because delivering against the Sector Deal commitments will help unlock Scotland's potential [22].

- Scottish Energy Strategy (2017) [23] established 2030 whole-system targets for Scotland. These were:

- The equivalent of 50% of the energy for Scotland’s heat, transport and electricity consumption to be supplied from renewable sources; and

- An increase by 30% in the productivity of energy use across the Scottish economy.

- Scotland's overall approach to energy within the context of Net Zero is driven by the need to decarbonise the whole energy system, in line with emissions levels set out in the Climate Change (Scotland) Act. The strategy recognises that “No-one can be certain what that future system will look like. However, we should be confident and ambitious about what we can achieve and deliver over the short to medium term, and focus on the areas where we know there are likely to be low or no regrets options.” A framework for the categorisation of options as being “low or no regrets” is included at Section 3.6.

- Future uncertainty in energy system evolution is modelled through two future scenarios: an “electric future” and a “hydrogen future”. In the electric future scenario, electricity generation accounts for around half of all final energy delivered. Electricity demand is consequently 60% higher than it was in 2015 and Scotland remains an integral part of the GB electricity system. In the hydrogen future, hydrogen is produced from strategically placed electrolysers and Steam Methane Reformation plants with Carbon Capture and Storage (CCS). While the strategy acknowledges that Scotland’s energy system in 2050 is unlikely to match either of these scenarios, it recognises that it will probably include aspects of both. Against this context, the development of a large, deliverable, cost-efficient offshore wind asset is a low regrets enabler of both.

- The strategy describes how the Scottish Government will continue to champion and explore the potential of Scotland’s huge renewable energy resource, and its ability to meet local and national heat, transport and electricity needs – helping to achieve Scotland's ambitious emissions reduction targets. The strategy also places a firm emphasis on the energy sector’s economic role, benefits and potential, from established technologies to those that are new or still emerging. Scotland continues to lead global efforts to decarbonise and tackle climate change, and to be recognised internationally for doing so.

- In 2021, Scottish Government released a position statement which provides an update on those policies set out in the Scottish Energy Strategy (2017). It reinforces Scottish commitment to remain guided by the key principles set out in Scotland’s Energy Strategy in 2017 and the importance the Scottish Government attaches to supporting the energy sector in its journey towards Net Zero. Scotland's Energy Strategy Position Statement [24] describes the continued growth of Scotland’s renewable energy industry as fundamental to enabling the creation of sustainable jobs as well as enabling the transition to net zero. The Scottish Offshore Wind Policy Statement [22] and Sectoral Marine Plan for Offshore Wind Energy in Scotland [25] describe the importance of offshore wind to Scotland’s economy.

- The Scottish Offshore Wind Energy Policy Statement sets out Scotland's ambition to capitalise on the potential that offshore wind development can bring, and the role that the technology could play in meeting Scotland's commitment to reach net zero by 2045. It explains that Scottish offshore wind generation will play a vital part in helping Scotland meet its hugely challenging climate change targets, effectively and affordably, while taking into account wider environmental factors and the interests of other users of the sea. Offshore wind is stated as being one of the lowest cost forms of electricity generation at scale, offering cheap, green electricity for consumers. It is also recognised in the Scottish Offshore Wind Energy Policy Statement, that offshore wind has the important potential for connection with green hydrogen production at scale, which adds another potential layer to Scotland’s rich energy portfolio. The Scottish Offshore Wind Policy Statement supports the development of between 8 and 11GW of offshore wind capacity by 2030, and the Sectoral Marine Plan supports the Scottish government's view that this capacity of offshore wind capacity is possible in Scottish waters by 2030. This Plan recognises that Scottish waters offer significant potential to maximise opportunities to deliver a green recovery, meet Scotland's ambitious targets for Net Zero and build a Blue Economy (defined by the World Bank as the “sustainable use of ocean resources for economic growth, improved livelihoods, and jobs while preserving the health of ocean ecosystem”). The Plan provides the framework for the pivotal role that offshore wind energy will play in redeveloping Scotland’s energy system over the coming decades.

- However the Sectoral Marine Plan also recognises that as the amount of planned and constructed offshore wind development increases, opportunities to install offshore wind farms close to shore and/or in shallower waters will decrease, resulting in the need to explore opportunities to develop sites located further offshore and/or in deeper waters in order to capitalise on the potential that offshore wind offers to Scotland. The Sectoral Marine Plan provides the strategic framework for the first cycle of seabed leasing for commercial-scale offshore wind by Crown Estate Scotland (CES), the “ScotWind” leasing round, for which Plan Options have been identified across four deeper water regions (see Figure 3‑5). Results of the ScotWind leasing round were announced in January 2022 and an analysis of the results is at Section 3.7.

- Offshore wind developments which are sited either further offshore or within deeper water locations are described in the Sectoral Marine Plan as posing technical and financial constraints which are “new” - i.e. are not present in closer to shore and/or shallower water developments. Such constraints will need to be overcome in order to secure the success of deeper water projects.

- Scotland's Climate Change Plan 2018 - 2032 (published in 2018) was updated during 2020 [21]. It sets out in detail the role that electricity generation will have in the wider energy system and restates Scotland's commitment not only to deliver to its decarbonisation targets, but also to continue to ensure a future with a sustainable security of electricity supply. The update states that carbon capture and storage is essential to reach net zero emissions and includes the focussed contemplation of negative emission technologies and hydrogen to deliver clean cross-sector energy supplies. Specifically, the update envisions that in 2032, at least 50% of Scotland's energy demand across heat, transport and electricity will be met from renewable sources; and that there will be a substantial increase in renewable generation particularly through new offshore and onshore wind capacity. Passenger travel by rail and private road transport will also be largely decarbonised and home energy use will also be on a path to the adoption of electricity-based solutions for heat which take advantage of the large potential for growth of onshore and offshore wind capacity in Scotland.

- Recognising that the decarbonisation of heat, industry and transport are now priorities and require a broader range of technologies, strategies and energy systems, Scotland's Hydrogen Policy Statement [26] recognises the abundance in Scotland of the ingredients in green hydrogen production - water and wind - and seeks to enable Scotland to become producer of the lowest cost hydrogen in Europe by 2045. The scale of the hydrogen market depends on its cost, so driving down the cost of offshore and onshore wind electricity production will be key to cost-effective green hydrogen production. Recognising that large scale renewable hydrogen production may also provide essential energy balancing and flexibility functions to integrate the expected large increases in offshore wind into the UK energy system, Scottish Government will work with the UK Government to ensure alignment of policies and to ensure that market mechanisms are developed in tandem to reflect this system need.

- Scotland currently opposes the build of new nuclear stations using current technologies because of the poor value for consumers that the Scottish Government believes they provide. However, the Scottish Government recognises an increasing research and industry interest in the development of new nuclear technologies such as Small Modular Reactors. Scotland's policy position is therefore is that it has a duty to assess all other new nuclear technologies based on their safety, value for consumers, and contribution to Scotland’s low carbon economy and energy future.

3.5. Current UK policies to meet Net Zero

3.5. Current UK policies to meet Net Zero

- The UK’s NDC draws on the following policy positions, some already in place and others in development or to be developed.

- The Clean Growth Strategy [2] contains UK Government’s current policies and measures to decarbonise all sectors of the UK economy through the 2020s and beyond. Of particular relevance to this Statement of Need, are: the roll out of low carbon heating to UK homes; accelerating the shift to low carbon transport; and delivering clean, smart and flexible power, including the development and delivery of an ambitious Sector Deal for offshore wind.

- In March 2019 the UK government announced its ambition to deliver at least 30GW of offshore wind by 2030, as part of the Offshore Wind Sector Deal [27]. The Sector Deal reinforced the aims of the UK’s Industrial Strategy and Clean Growth Strategy, which seeks to maximise the advantages for UK industry from the global shift to clean growth, and in particular: “The deal will drive the transformation of offshore wind generation, making it an integral part of a low-cost, low carbon, flexible grid system.” The deal paved the way for further ambition in the offshore wind sector. The Prime Minister’s Ten Point Plan [28], which aims to “make the UK the Saudi Arabia of wind with enough offshore capacity to power every home by 2030,” confirmed the upward revision of the capacity of offshore wind targeted for deployment in UK waters by 2030 from 30GW to 40GW. The Ten Point Plan also advances the UK’s electric vehicle charging infrastructure and battery manufacture capability, and targets investment to “make homes, schools and hospitals greener, and energy bills lower”.

- The 2020 Energy White Paper [29] sets out government’s strategy to tackle climate change. It explains how the UK “will generate new clean power with offshore wind farms, nuclear plants and by investing in new hydrogen technologies ... [using] this energy to carry on living our lives, running our cars, buses, trucks and trains, ships and planes, and heating our homes while keeping bills low”. The Energy White Paper anticipates that onshore wind and solar will be key building blocks of the future generation mix, along with offshore wind, explaining that the UK needs sustained growth in the capacity of these sectors in the next decade to ensure that it follows a pathway which will meet net zero emissions in all demand scenarios by 2050. Key policy statements include eliminating the use of natural gas to heat our homes; ensuring that clean electricity becomes the predominant form of energy while retaining the essential reliability, resilience and affordability of UK energy supply; and decarbonising transport. Specifically, the Energy White Paper reiterates the revised Offshore Wind Sector Deal target of delivering 40GW of offshore wind by 2030, including an ambition to deploy 1GW floating wind in the same timeframe. As a less-established technology, floating offshore wind will undoubtedly require further demonstration projects to drive down costs, pushing its deployment at scale further into the future.

- Build Back Greener, HM Government's Net Zero Strategy for the UK [30] reiterates the keystone policies included in other publications and commits to take actions so that by 2035, all our electricity will come from low carbon sources, including offshore wind (importantly aligning with the Sector Deal), onshore wind and solar. The strategy recognises the need to deploy existing low carbon generation technologies at close to their maximum potential to reach the sixth Carbon Budget, as well as improving the cost efficiency of offshore transmission networks and cable routes. The strategy describes an approach for the 2020s of taking “no or low regrets” actions, which are defined as those that are cost-effective now and will continue to prove beneficial in future. They include actions taken to reduce demand and avoid locking in to high-carbon solutions, instead pursuing low carbon alternatives to drive deployment at scale. A framework for the categorisation of actions as “no or low regrets” is included at Section 3.6.

- The step change in low carbon infrastructure development required to meet Net Zero has resulted in the publication of revised draft National Policy Statements (NPS) [31, 32] to support planning decisions in England and Wales. Draft NPS EN-1 sets out the Government’s policy for delivery of major energy infrastructure, and EN-3 covers both onshore and offshore renewable electricity generation. Given the increasing urgency of action required to combat climate change, the draft NPSs are recognised as being “transformational in enabling England and Wales to transition to a low carbon economy and thus help to realise UK climate change commitments sooner than continuation under the current planning system.” The fundamental need for the large-scale infrastructure which draft NPS EN-1 considers remains the legal commitment to decarbonisation to Net Zero by 2050 in order to hold the increase in global average temperature due to climate change, to well below 2°C above pre-industrial levels. In noting the crucial national benefits of increased system robustness through new electricity network infrastructure projects, draft NPS EN-1 also recognises the particular strategic importance this decade of the role of offshore wind in the UK’s generation mix. Offshore wind “presents the challenge of connecting a large volume of generation located beyond the periphery of the existing transmission network” and therefore sets an “an expectation that there will be a need for substantially more installed offshore capacity … to achieve Net Zero by 2050.”

- In April 2022, the UK government published an urgent British Energy Security Strategy (BESS) [108]. While the BESS is not strictly a policy in support of Net Zero, the measures it seeks to encourage do support Net Zero and increase the case for need for the Project. Key points from the BESS are therefore introduced at this point in this Statement of Need.

- The BESS is relevant to the case for need for the Project because it explains the important energy security and affordability benefits associated with developing electricity supplies which are not dependent on volatile international markets and are located within the UK’s national boundaries. The urgency for an electricity system which is self-reliant and not reliant on fossil fuels is enormous in order to protect consumers from high and volatile energy prices, and to reduce opportunities for destructive geopolitical intrusion into national electricity supplies and economics.

- The BESS raises the UK’s ambitious target of 40GW of offshore wind operational by 2030, by 25% to 50GW, up from 13.6GW in July 2022 [107]. Section 9 following provides an overview of the current The Crown Estate (TCE) Project Listings [10], which show that delivery of 53% of the current forward offshore wind pipeline, at the currently proposed capacities, would be required in order to meet the BESS aims.

- The clear UK Government policy established in the BESS is being delivered in part via the Energy Security Bill, which was introduced to the UK Parliament on 6th July 2022 and as at October 2022 is progressing through Parliamentary process.

- With increasingly interconnected markets – in electricity as well as source fuels such as coal oil and gas – market shocks can be felt through neighbouring international markets and more broadly. Oil and coal, historically international markets, drive global prices through supply chains which connect source and need and the many markets and exchanges which allow swaps and trades to be transacted across the world. Although gas has historically been supplied through pipeline (i.e. fixed) infrastructure, Liquefied Natural Gas has become increasingly prominent in connecting gas supplies with markets. Gas is now much more of a global market than once it was.

- In 2021, BEIS unveiled plans to decarbonise UK power system by 2035 by building a secure, home-grown energy sector that reduces reliance on fossil fuels and exposure to volatile global wholesale energy prices [91].

- The first quarter of 2022 demonstrated how the UK is exposed to volatile energy prices through international energy markets in gas, oil (and its derivatives) and coal. Energy commodity price rises in 2022 have and will continue to filter through to consumer electricity bills. While the UK once was energy independent, it now is dependent on imports of (in particular) oil and gas. The UK’s dependency on imports increases its exposure to volatile international prices, particularly when either demand is high in other markets (e.g. a deep cold period in South East Asia in late 2020) or supply is risked through the weaponization of energy supplies, as has been the case since early 2022.

- In the BESS, the Prime Minister at the time wrote: “If we’re going to get prices down and keep them there for the long term, we need a flow of energy that is affordable, clean and above all, secure. We need a power supply that’s made in Britain, for Britain.” [108, p3]

- The BESS sets out the immediate need to manage the financial implications of soaring commodity prices in the near term, on households and businesses which are already feeling economic pain as the post-Covid cost of living has risen: “The first step is to improve energy efficiency, reducing the amount of energy that households and businesses need." [108, p5].

- However the strategy also sets out the long-term goal of “address[ing] our underlying vulnerability to international oil and gas prices by reducing our dependence on imported oil and gas." [108, p6].

- The BESS aims to:

- Increase the pace of deployment of Offshore Wind by 25%, to deliver up to 50GW by 2030, including up to 5GW of innovative floating wind. Wind will contribute over half the UK’s renewable generation capacity by 2030. [108, p16];

- Consider all options, including Onshore Wind, through the improvement of national electricity network infrastructure and support of a number of new English projects with strong local backing, so prioritising “putting local communities in control" of local onshore solutions. Repowering of existing onshore wind sites is also under consideration. [108, p18];

- Support a 5-fold increase in deployment of solar technology by 2035, recognising the abundant source of solar energy in the UK and an 85% reduction in cost over the last ten years, of solar power;

- Increase UK plans for deployment of civil nuclear to up to 24GW by 2050 – three times more than operational capacity in 2022, and representing up to 25% of our projected electricity demand. This includes the intention to take one project (Sizewell C) to Financial Investment Decision (FID) during the current Parliament, and two projects to FID in the next Parliament, including Small Modular Reactors, subject to value for money and relevant approvals. [108, p21]. The selection process for further UK projects is anticipated to be initiated in 2023 [108, p22]; and

- Double the UK ambition for hydrogen production to up to 10GW by 2030, with at least half of this from electrolytic hydrogen [108, p22], facilitated by bringing forwards up to 1GW of electrolytic hydrogen into construction or operational status by 2025.

- Section 4.5 of this Statement of Need describes the electrification of GB homes as a key driver of future electricity demand. The BESS pursues this aim with increased vigour: electrification is a key measure not only for decarbonisation but also for energy security and affordability reasons. In the near-term, the BESS sets out a high-level action plan to upgrade the energy efficiency of at least 700,000 homes in the UK by 2025, and to ensure that by 2050 all UK buildings will be energy efficient with low-carbon heating. Further, the BESS sets out an intent to phase out the sale of new and replacement gas boilers by 2035, thereby furthering the electrification of heat in homes. [108, p12].

- The BESS also notes the improved cost competitiveness of electrically powered heat pumps which can displace natural gas from use in homes and buildings. Government is targeting 600,000 heat pump installations per year by 2028 and aims to expand heat networks and designated heat network zones to further the electrification of home and commercial heating. A “Rebalancing" of the costs placed on energy bills away from electricity is also intended to incentivise electrification across the economy and accelerate consumers and industry's shift away from volatile global commodity markets over the 2020s. [108, p12].

- Supporting the rollout of electric vehicles as part of Government’s electric vehicle infrastructure strategy, will also increase demand for electricity in future years, from potentially as early as 2023.

- The Society of Motor Manufacturers and Traders reported a 100% increase in Battery Electric Vehicle (BEV) sales in the UK in the year-to-date (end March-22) versus the same period last year, and over 16% of all new vehicle purchases in the UK in March-22 were BEV. Ongoing grants (available until at least March-23) and cheaper running costs are anticipated to continue to push EV market share over the coming years. [109].

- Government is also facilitating the adoption of electricity into transport through its Electric Vehicle Infrastructure Strategy (March 22) which sets out the expectation, by 2030, of there being around 300,000 public chargepoints as a minimum in the UK [up from just 30,000 in the first quarter of 2022], but there potentially being more than double that number, delivering “Effortless on and off-street charging for private and commercial drivers" [110, pp4&5].

- The rollout of a significantly higher capacity of renewable generation is therefore required to meet decarbonisation as well as energy security aims and the urgency for delivery as increased.

- Carbon Capture Usage and Storage (CCUS) retains its important potential role in a decarbonised economy. Government aims to deliver on their £1 billion commitment to four CCUS clusters by 2030, with the first two sites selected in the North East and North West currently proceeding through Track 1, with the Scottish Cluster in reserve. [108, p15].

- CCUS retains its important place within the BESS although it has not attracted a more prominent role relating to energy security than that with which it has already been tasked in the Energy White Paper and the Prime Minister’s Ten Point Plan, This is because CCUS is an enabler of eliminating carbon emissions from fossil fuel use, rather than providing a power source which does not require fossil fuels as an input energy source.

- Nuclear is poised for its third UK renaissance, but would only deliver its first megawatthours from the middle of the 2030s – and due to prevalent Scottish policy – not in Scotland. The UK’s nuclear renaissance of the 2000s resulted in the construction (currently ongoing) of just one nuclear power station, Hinkley Point C, which would currently not be completed until June 2027 with the possibility of a further 15-month delay to September 2028 [111].

- Although the BESS includes an aim to achieve a FID at one more nuclear power station by the end of the current parliament, it is important to recognise the significant political, financial and delivery risk associated with nuclear development. There is a long road ahead before any clean energy generated from nuclear technologies can be “banked" in the fight against climate change.

- The BESS recognises the critical role of renewables in accelerating the transition away from fossil fuels, and notes that renewable capacity in the UK is currently set to increase by a further 15% by the end of 2023. However further and faster actions are required to increase our national energy security and reduce our dependency on fossil fuels, and the exposure consumers currently have to their volatile prices.

- Accelerating the domestic supply of clean and affordable electricity also requires accelerating the connecting network infrastructure to support it, and the BESS also includes measures designed to increase the pace of improvements and enhancements to the NETS to enable the connection of the required level of renewable generation capacity both within the 2030 timeframe and beyond.

- Work has already commenced in this regard with the formation of a Future System Operator (a national organisation taking over the role of Electricity System Operator, currently carried out by National Grid) and programs of action such as the annual Network Options Assessment (NOA) and (ongoing at the time of writing) Holistic Network Design (HND), part of the Offshore Transmission Network Review, which aims to develop a strategy to coordinate interconnectors and offshore networks for wind farms and their connections to the onshore network and bring forward any legislation necessary to enable coordination. See also Section 9 below.

- The path to national control of nationally generated electricity and reduction of exposure to the volatile prices associated with international supplies of fossil fuels, and the path to a low-carbon energy system of the future, which minimises potentially catastrophic changes to the global climate, are the same path.

- The BESS provides an increase to the requirements for both the scale and the urgency of delivery of new low carbon generation capacity, by refocussing the requirement for low-carbon power for reasons of national security of supply and affordability, as well as for decarbonisation.

- The increase in ambition for hydrogen generation as set out in the BESS further supports the development of greater capacities of renewable generation and with greater urgency.

- Consenting the Development will be an essential boost to meeting the urgent need for low-carbon sources of electricity in the UK to meet growing electricity demand and the BESS ambitions for electrolytic hydrogen production by 2030.

3.6. Low and no regrets options

3.6. Low and no regrets options

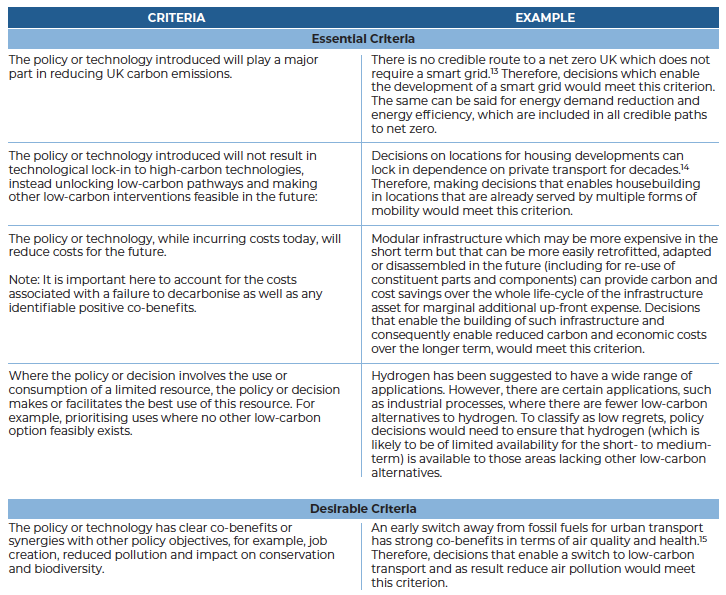

- Both the Scottish Energy Strategy [23] and the Net Zero Strategy for the UK [30] introduce the concept of “low and no regrets” options and actions. In 2021, the National Engineering Policy Centre (NEPC) authored and published a framework for rapid low regrets decision making for net zero policy [33]. The framework includes a definition for low regrets decisions as “urgent decisions that must and can be made now to have a significant impact on decarbonisation”. Such decisions would be expected to unlock pathways towards net zero, provide options and flexibility and not close off options. NEPC's framework includes four essential criteria and one desirable criteria for low regrets decisions, included at Table 3‑1. Although the framework is designed to be applicable across the UK, it is here proposed that it is applicable also to Scottish decisions for Scotland, and therefore provides support in favour of the case for consent of the Project.

Table 3‑1: Framework for low regrets decisions

[33]

- This Statement of Need makes the case that consenting the Project is a no or low regrets decision for Scotland for the following reasons:

- Section 6.2, Section 6.3 and Section 6.5 illustrate that offshore wind will play a major part in reducing Scottish carbon emissions, and the Project is an essential element of the future Scottish offshore wind project pipeline;

- Section 5.5 illustrates that rather than locking in high carbon technology, the Project helps lead away from high carbon technology, for example, Section 4.7 describes the important role of offshore wind generation in the production of green hydrogen in Scotland. Further, Section 8.4 describes the beneficial effect a large fixed-bottom offshore wind fleet is expected to have on rapidly reducing the costs anticipated for floating offshore wind projects, therefore increasing the pace with which this nascent technology may come to market at scale;

- The Project, as well as supporting future cost reductions in floating offshore wind, will reduce the future cost of electricity to consumers. Section 8.2 describes how deploying higher capacities of offshore wind will displace more expensive generation technologies from the grid and therefore reduce the marginal price of power in Great Britain;

- The Scottish Offshore Wind Policy Statement sets out Scotland's near-term ambitions for the sector, and the Scottish Offshore Wind Green Hydrogen Opportunity Assessment articulates the important role offshore wind is expected to play in Scotland over the longer term. Seabed generally is in abundance in Scotland, however there are no seabed areas other than the proposed location of the Proposed Development which are of the required size and characteristics to host 4.1GW of low carbon offshore wind generation. The proposed seabed area should therefore be used for the important purpose of generating significant quantities of low carbon power. Section 3.7 and Section 7.9 describe that, if consented, the Project would become operational earlier than any other available options; that no other available options have been demonstrated to attract less environmental harm than the Proposed Development, and the Proposed Development is likely to be completed for a lower cost than other options of the same capacity, due to the water depth and seabed structures at the location, its proximity to viable grid connection points, and achievable scale.

- The Project has clear co-benefits in that the power it would generate would increase indigenous Scottish low carbon electricity sources, for use in the substitution of fossil fuels from use in the heat and transport sectors as described in Section 4.

3.7. The ScotWind leasing round

3.7. The ScotWind leasing round

- The primary purpose of ScotWind Leasing is to grant property rights for seabed in Scottish waters for new commercial scale offshore wind project development. Marine Scotland, part of Scottish Government and the planning authority for Scotland’s seas and custodian of the National Marine Plan, leads in the identification of potential areas suitable for commercial scale offshore wind development.

- The first cycle of ScotWind Leasing - the first in a decade - opened for registration in 2020. Up to 8,600 square kilometres of Scottish seabed was available across multiple Plan Option Areas, with the expectation that ultimately, in total up to 10GW of offshore wind capacity would be developed within them [34]. Scotland's Sectoral Marine Plan for Offshore Wind Energy [25] noted that limiting the scale of development under the Plan to 10GW was required to reduce or offset the potential environmental effects of development. The Option Period associated with each lease is 10 years, after which time a lease cannot be requested so a project cannot be constructed.

- The first leasing round concluded in January 2022 with the award of 17 leases covering 7,343 square kilometres and a maximum potential capacity estimate of 24.8GW.

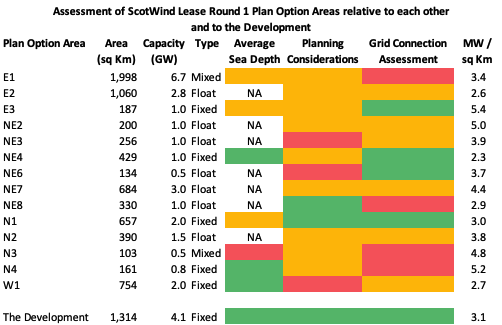

- For comparison, the Proposed Development is proposed to install 4.1GW of offshore wind over a total area of 1,314 square kilometres of varied seafloor morphology with sea depths ranging from 32.8m to 68.5m (measured against Lowest Astronomical Tide). The average sea depth across the Proposed Development Array Area is 51m.

- By awarding leases for significantly greater generation capacity development than the 10GW limit established in the Sectoral Marine Plan, CES has increased its ambition for the delivery of new offshore wind projects but also has allowed for attrition rates which will be likely due to the nature of the leasing and development processes. Scottish Renewables recommended a 30% MW attrition rate in their 2018 “An industry view of the Draft Sectoral Marine Plan for Offshore Wind” in order to reflect the more challenging conditions in Scottish offshore waters relative to the rest of the UK, particularly regarding water depth, ground conditions and grid charges.

Figure 3‑5: ScotWind Lease Round 1 Plan Option Areas and Scotland's onshore transmission network

Adapted from [35, 36, https://www.offshorewindscotland.org.uk/scottish-offshore-wind-market/]

- ScotWind Leases have been awarded to 9.8GW of fixed bottom offshore wind, 14.6GW of floating offshore wind (FOW), and 0.5GW in a Plan Option Area with mixed technology. Although the Plan Option Areas with fixed bottom technology are generally located closer to shore than those with floating technology, 6.4GW of fixed bottom wind is proposed in areas with average sea depth greater than 60m, a depth which is technically achievable for fixed bottom wind, but potentially with greater complexity and therefore associated cost and time, than installation in shallower seas. 3.4GW of fixed bottom offshore wind is proposed for Plan Option Areas with a depth comparable to that of the Proposed Development Array Area (<60m).

- The total Development Plan Option area identified in the Sectoral Marine Plan covered 12,810 square kilometres across 16 identified areas, with a maximum development scenario of 26GW, likely delivering in the early 2030s. The significant majority of successful projects marry up to entries on the TEC Register [16], leading to the conclusion that offers for sufficient grid connection capacity to accommodate wind capacity delivered under ScotWind Lease Round 1 have already been issued to and accepted by developers. The majority of grid connection dates are currently scheduled for 2033.

- Large (>100MW) generators generally require connection to higher voltage (>=275kV) circuits to be able to export their power in a safe secure and efficient manner. Figure 3‑5 shows an overlay of Scotland's onshore transmission network on the locations of the Plan Option areas, with 275kV circuits coloured red and 400kV circuits coloured blue. It is clear that some Plan Option Areas are less accessible to suitable grid connection points than others, and in the detailed studies to follow a further level of attrition may occur. In any event, longer grid connections tend to be more expensive and the reliability of High Voltage DC (HVDC) cables decreases with their length. Section 7.8 also provides an overview of the outcomes of National Grid’s Holistic Network Design the challenges associated with connecting generation above National Grid boundaries in Scotland, related to grid constraints and the grid strengthening required to enable larger power flows from north to south in future years.

- A comparison of the number of different planning considerations highlighted as potentially significant in Scotland's Sectoral Marine Plan for Offshore Wind Energy identifies that some Plan Option Areas require detailed study and analysis to understand and mitigate potential harm arising from development, a process which in at least some cases may take many years.

- Potentially significant planning considerations include visual amenity (both seascape and landscape impacts), shipping and navigation, MoD impacts (including facilities and radar interactions), fish spawning and habitation as well as commercial fishing grounds, bird populations (including five areas to the north east which have been classified as being “subject to higher levels of ornithological constraint”, benthic seabed areas and in one instance, noise (due to proximity to human populations). Many of these considerations are common across multiple Plan Option Areas, and some are common also with factors which have been addressed in the process of preparing a planning application for the Proposed Development.

- A summary of this qualitative analysis is included at Table 3‑2.

- The following assessment criteria drive the colour coding in Table 3‑2.

- Average Sea Depth. Green: Mainly <60m. Amber: mainly 60 - 100m. Red: mainly >100m. FOW not graded.

- Planning Considerations. Green: <3 significant topics. Amber: 3 or 4 significant topics. Red: 5 or more significant topics. Gravity of significant topic not assessed.

- Grid Connection. Green: shortest distance from Plan Option Area to closest point of connection (POC) on existing 275kV or 400kV point of connection (POC) is comparable to the Project’s Branxton POC distance. Amber: shortest distance is greater than the Project’s Branxton POC distance. Red: shortest distance is significantly greater than the Development's POC distance. Actual cable route not considered.

Table 3‑2: Assessment of ScotWind Lease Round 1 Plan Option Areas relative to each other and to the Project